when will i get my minnesota unemployment tax refund

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

Minnesota Lawmakers Get Some Hits Lots Of Misses In Session

About 500000 Minnesotans are in line to.

. When will I get the refund. Base Tax Rate for 2022 from 050 to 010. If the IRS finds that you are due a refund for the unemployment tax credit it will immediately amend your return and give you a refund with no more action on your part.

Minnesota Department of Revenue Mail Station 0020 600 N. Paul MN 55145-0010 Mail your property tax refund return to. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Call the automated phone system. Saturday July 30 2022. This process is expected to be finished in early 2022 meaning some will have to wait until next year to get a refund.

View step-by-step instructions for accessing your 1099-G by phone. Paul MN 55145-0020 Mail your tax questions to. For Income and Property Tax.

Tax refunds on unemployment benefits to start in May. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill.

Your tax return has errors. Minnesota Department of Revenue Mail Station 0010 600 N. Additional Assessment for 2022 from 1400 to 000.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. Federal and MN State unemployment tax refund. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this.

Mail your income tax return to. You can call our automated phone line at 6512964444 or 18006573676 to get the status of your refund. The first refunds are expected to be issued in May and will continue into the summer.

State lawmakers managed to pass the law the day before the April 30 deadline to submit taxes but alas some businesses had already paid their quarterly taxes at the higher rate. Use our Wheres My Refund. I realize there is a priority system for receiving Federal and MN State unemployment tax refunds but should I be concerned about not receiving any direct communication at all or refund ultimately regarding this.

The new law reduces the. Unemployment 10200 tax. The IRS said additional 15 million taxpayers will get tax refunds due to changes to previously filed income tax returns due to unemployment benefits.

Call our automated phone system available 247 at 651-296-4444 or 1-800-657-3676. About 560000 tax returns are impacted by the change which was the last bill to clear the state capitol during special sessionGov. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

Where is my 2020 MN property tax refund. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. How do I check my MN property tax refund.

Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

This is the latest round of refunds related to the added tax exemption for the first 10200 of.

Minnesota Department Of Employment And Economic Development Deed Has Authorized The First Payments Of The Temporary Additional Compensation Of 600 Week For People Receiving Unemployment Benefits You Don T Need To Contact Us

Where S My Refund Minnesota H R Block

Ppp Ui Tax Refunds Start In Minnesota

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News

Registration For Minnesota Hero Pay Tentatively Set For June

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Minnesota Senate Passes Permanent Tax Cuts To Refund 9 Billion Surplus Wizm 92 3fm 1410am

Minnesota Salt Cap Workaround Salt Deduction Repeal

Letters We Have A Huge Budget Surplus In Minnesota Stop Taxing Social Security Twin Cities

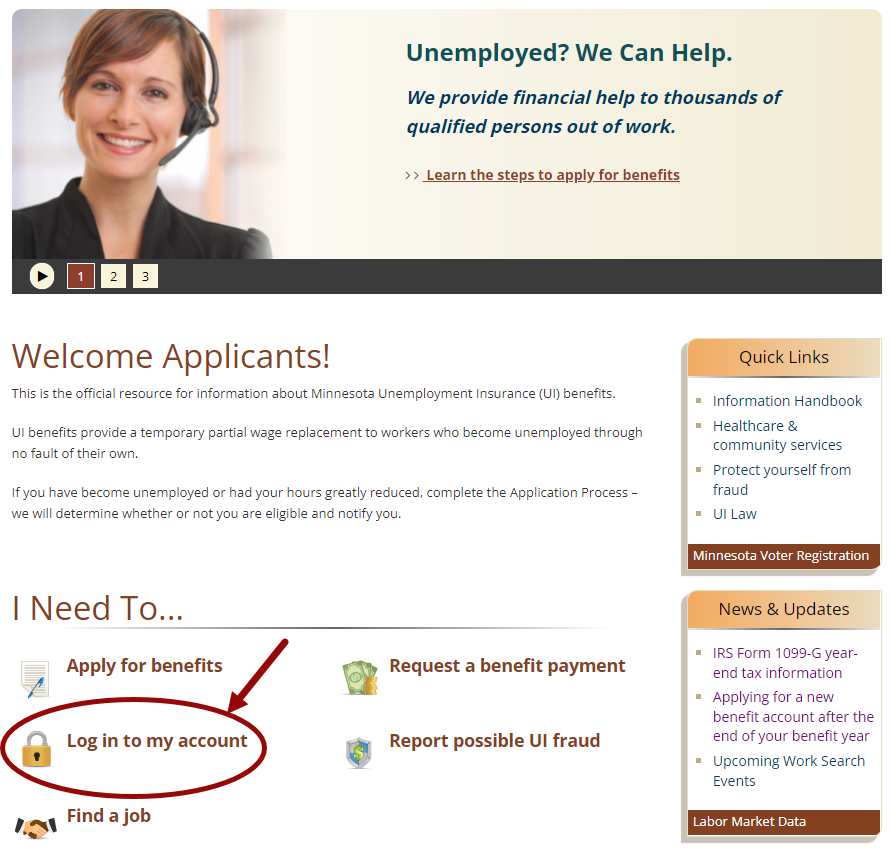

A New Look Is Coming To Your Minnesota Unemployment Insurance Account Employers Unemployment Insurance Minnesota

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

Minnesota Legislature Passes Federal Conformity Bill

New Minnesota Law Provides Frontline Worker Bonus Payments Barnes Thornburg

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Minnesota Department Of Revenue Set To Begin Processing Unemployment Insurance And Paycheck Protection Program Refunds Christianson Pllp

Number Of Weeks Of Ui Paid Applicants Unemployment Insurance Minnesota